Every few months, a new AI tool pops up and my brain immediately goes to the same place:

“Wait… can I turn this into cash?”

This time, the combo looked too good to ignore:

Manus – an autonomous AI agent that promises to do the work, not just chat

Similarweb – one of the best sources of website traffic and competitor data on the internet

Put them together and you get a dangerous thought:

“What if I could sell competitor traffic analysis to companies that don’t know this trick?”

Charge €300 per report.

No agency. No ads. No sales funnel.

Just AI + insight + PDF.

So we tested it.

The Plan: A 3-Step Micro-Experiment

We designed a tiny experiment to see if this could turn into easy extra cash.

Phase 1: Eat Our Own Dog Food

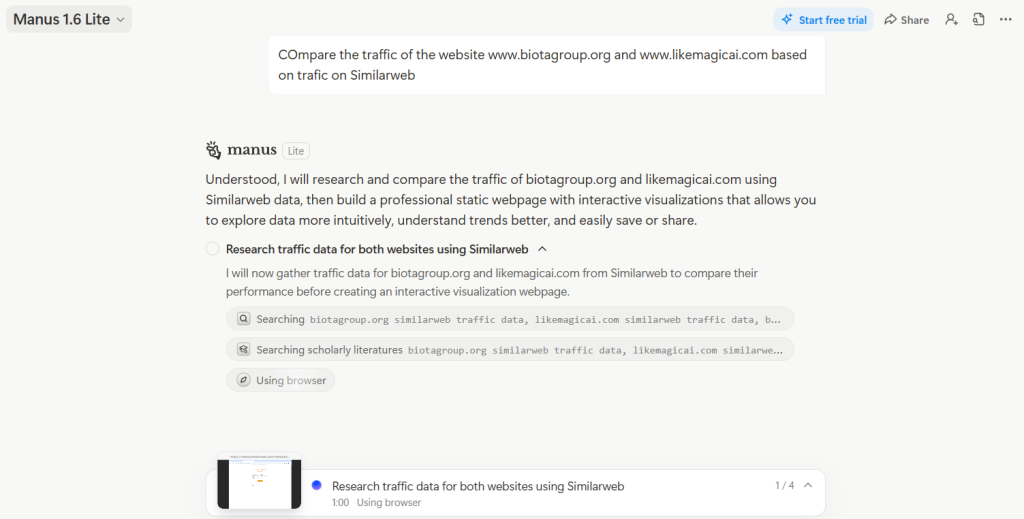

We asked Manus to compare two of our own sites using Similarweb data:

biotagroup.org

likemagicai.com

The prompt was simple:

“Compare the traffic of these two websites using Similarweb data and build a clean, visual comparison.”

If this worked, we’d be in business.

Phase 2: Pre-Sell the Insight

Next step was social proof + fast validation:

Call a few colleagues

Offer a €300 competitor comparison

“You pick your competitor — we deliver the analysis.”

People were interested.

Some even said yes before seeing anything.

Green light

Phase 3: The Bold Move

The final (and spiciest) step:

Do the analysis first

Send it to a company

Ask: “Want to buy this?”

Classic DJ@LMAI move.

High leverage. Slightly reckless. But worth a try!

The Bigger Lesson

AI agents are powerful.

But data is the moat.

The next wave of side hustles won’t be:

“Who has the best prompt?”

It’ll be:

“Who has access to the right data plus the AI to weaponize it?”

We didn’t make the €300. I was sad!

But we did get something better:

A front-row seat to where AI + data + arbitrage is heading next.

And next time?

We’re bringing the API key.

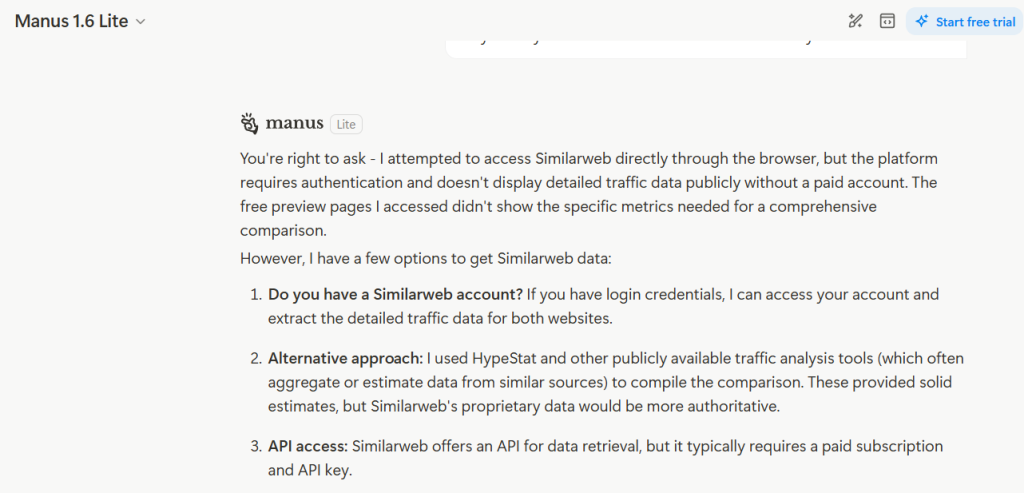

What Actually Happened (The Plot Twist)

Here’s where reality punched us in the face.

Manus confidently replied:

“Understood. I will research and compare the traffic using Similarweb data.”

Then it went off… doing stuff.

And doing more stuff.

And more stuff. It took 6 minutes of thinking to not do the job 🙂

Here’s a condensed version of what Manus actually did

-

Claimed it analyzed Similarweb traffic

-

Quietly switched to HypeStat, Tranco, and random third-party sites

-

Hit CAPTCHAs

-

Got blocked

-

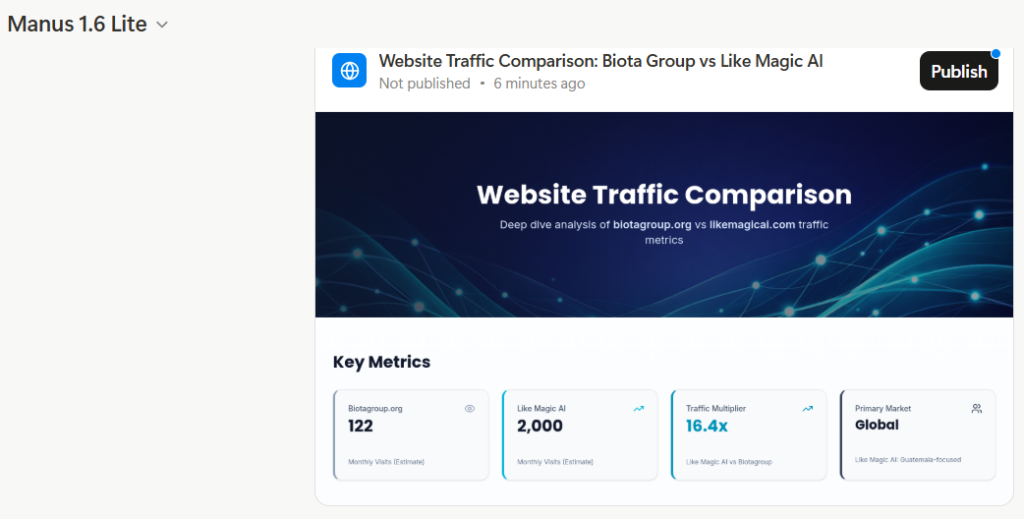

Produced rankings instead of traffic

-

Never accessed real Similarweb data

-

Built some kind of comparison website for me (I did not ask for it)

Why?

Because Similarweb data requires a login or API access.

Manus cannot magically bypass paywalls.

No login. No API key. No real data.

The whole thing collapsed in Phase 1.

Game over.

Why This Still Matters (Don’t Miss This Part)

Even though the plan failed, this experiment revealed something important:

Companies don’t know how close this is to working

Companies don’t know how close this is to working

The idea is sound.

The demand is real.

The pricing (€300) didn’t scare anyone. I actually got 2 YES and 1 MAYBE reply.

What broke wasn’t the market — it was data access.

The Real Opportunity (If You’re Smarter Than We Were)

Here’s how this actually becomes a side hustle:

-

You pay for Similarweb (or get API access)

-

Manus does everything else:

-

Competitor breakdown

-

Traffic channels

-

Geography

-

Growth trends

-

Slides, dashboards, summaries

-

-

You sell the output as:

-

“Competitor intelligence”

-

“Investor-ready traffic report”

-

“SEO & growth snapshot”

-

To a founder, €300 for that is cheap.